Tariffs are hitting Jane and John Does

Despite the relief the Sino-American trade truce might procure to farmers, it could be too late to avert the next crisis: endogenous inflation and the ensuing political discontent.

By targeting U.S. soybeans, China initially accelerated a latent agricultural crisis, but the most severe damage has proven to be self-inflicted. Now that American households are feeling the effects of tariffs on their purchasing power and on vital goods like food products, the Trump administration is scrambling to dismantle the tariff arsenal it has built up since April.

While China has lately secured at least 10 additional cargoes in recent weeks, pushing soybeans seasonal purchases above 2 million metric tons, this modest reprieve does not compensate for past damages. Trade frictions and plummeting Chinese demand crippled U.S. farmers’ revenue, leading to a surge in defaults and bankruptcies. Consequently, the Trump administration made sectoral support its top priority.

Post-shutdown, the administration clearly established its fiscal priorities. The USDA (US Department of Agriculture) budget is ring-fenced for the entirety of fiscal year 2026 (through October 2026).

In the short term, farmers face acute liquidity constraints and cash flow risk until the promised federal support is actually disbursed. Secretary of Agriculture Brooke Rollins, speaking to Bloomberg News, confirmed a shift in circumstances since the initial discussions, indicating that the administration is now merely aiming to announce the aid package during the first week of December.

Limiting political damage

In the meantime, the White House is actively pursuing alternative measures to restore agricultural competitiveness in a sustained low-price environment. On November 14, the Administration published a list of over 200 tariff-exempt agricultural inputs, notably including specific categories of fertilizers. This policy reversal addresses a critical constraint: fertilizer costs for 2025 were projected to surge by +21%, according to the World Bank (October 29). By targeting input costs, the administration seeks to mitigate inflationary pressures embedded within the agricultural supply chain.

“Soybean producers are making difficult financial decisions as they plan for next year’s planting, following a challenging harvest season. The action taken today by President Trump will help reduce costs for a key component of soybean production,” stated Caleb Ragland, President of the ASA (American Soybean Association).

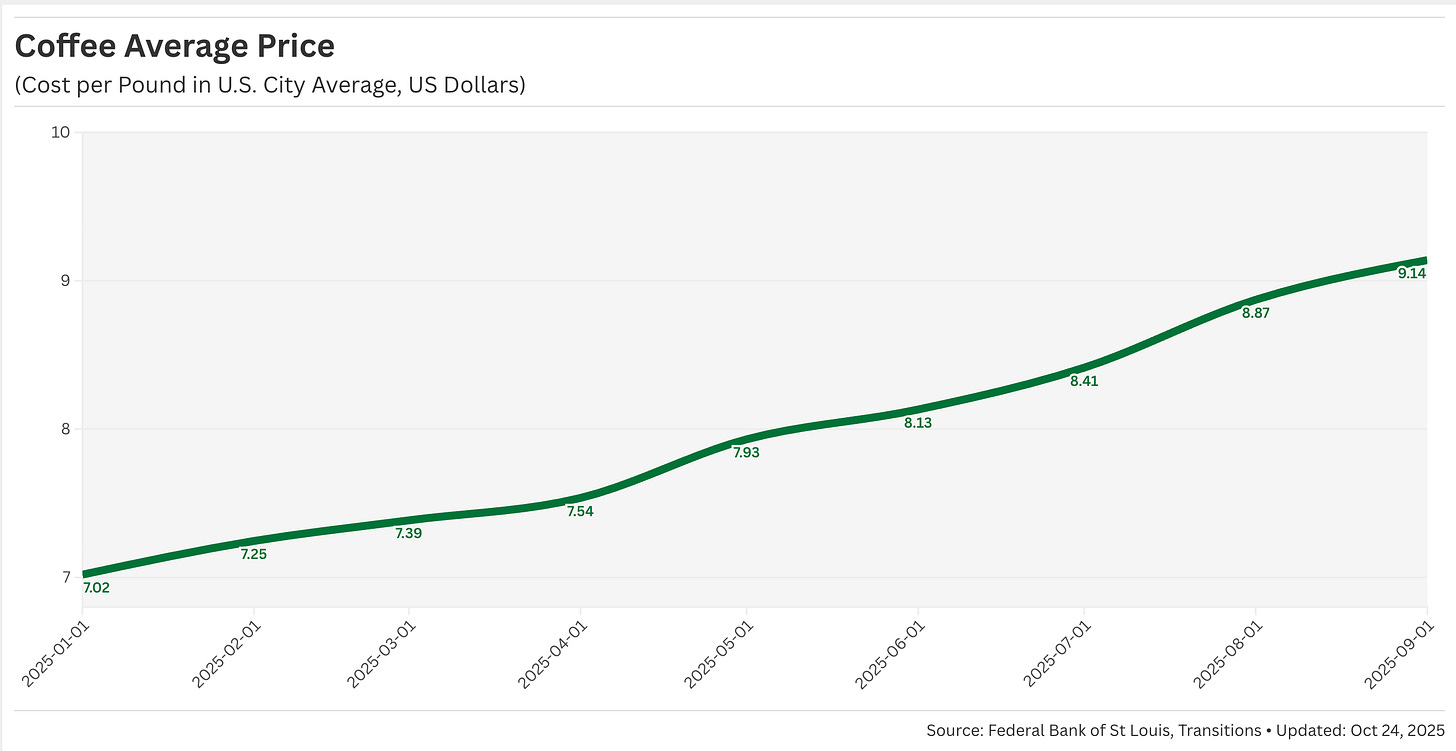

In a parallel diplomatic maneuver, the administration issued an Executive Order on November 20, excluding certain Brazilian agricultural imports - such as coffee - from the scope of the 40% ad valorem tariff put into place on July 30. This partial rollback is a diplomatic concession following “initial progress in negotiations” with President Lula da Silva, whose government was initially targeted over broader national security concerns.

Avoiding endogenous inflation

However, the political and fiscal support remains a secondary concern to the looming macro threat: the persistent, structural inflation that Washington’s own trade policies might have injected into the wider U.S. economy, a risk the Federal Reserve is now trying to assess.

The stark divergence within the Federal Reserve System underscores the profound uncertainty facing the U.S. economy. While the San Francisco Fed adopted a notably dovish stance, predicting that inflation—though tariff-linked—would naturally recede toward 2% next year, data from the Atlanta Fed offered a critical reality check. The Atlanta Fed’s surveys revealed that 40% of corporate cost increases are tariff-driven, and critically, that companies expect to raise prices through 2026 due to non-tariff-related internal pressures. This analysis confirms the endogenous inflation threat. Ultimately, the Federal Reserve Board’s final assessment reveals that participants expressed serious concern that the prolonged period of inflation above target risks an anchoring of longer-term expectations. The debate is inflammatory in the national political stage. “So far in 2025, the average family has paid more than $700 in higher costs,” estimates the Democrat minority of the Joint Economic Committee in a note.

The administration is navigating the unintended consequences of its trade policy, which might have triggered significant endogenous inflationary pressures that are currently eroding domestic purchasing power.