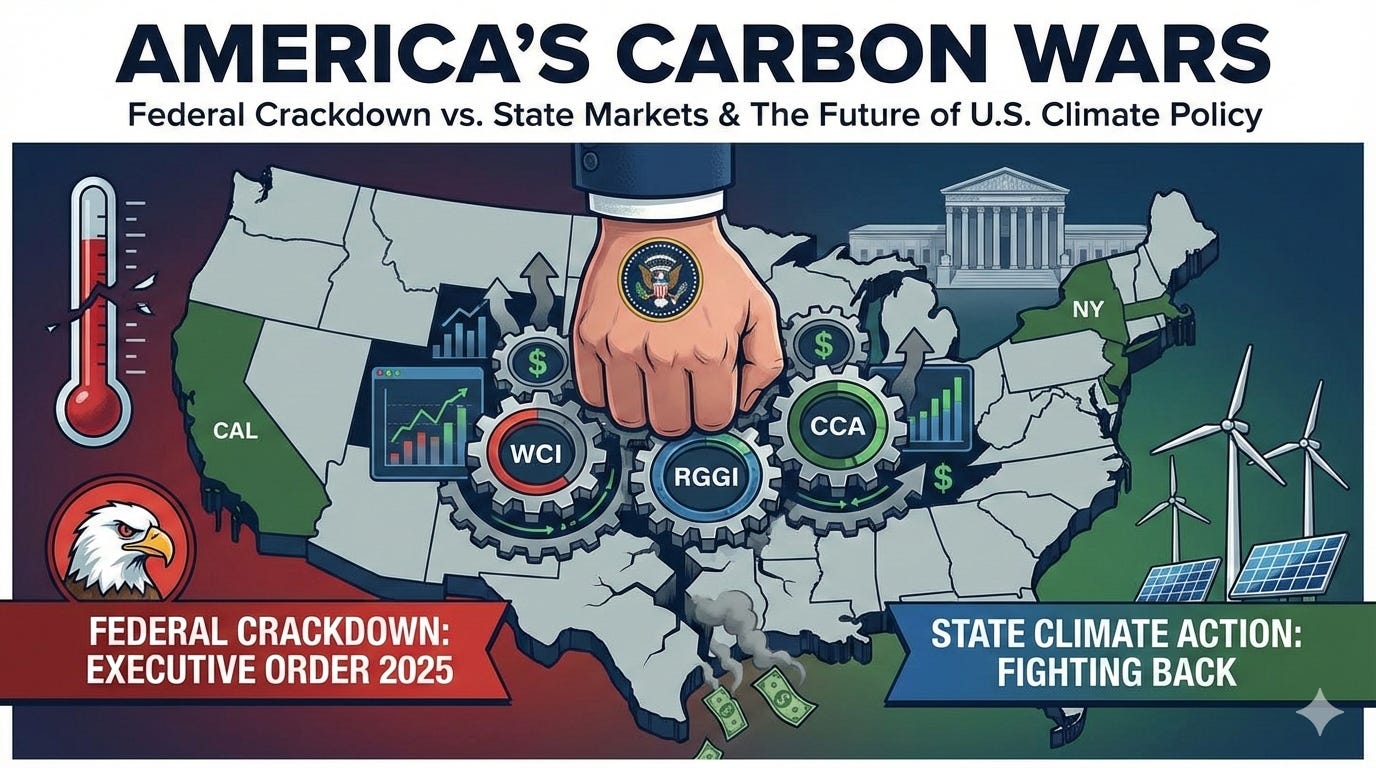

Carbon Markets: States Resist Federal Overreach

Survival of the price: How carbon pricing is navigating federal sabotage and a protectionist pivot, regardless of “climate hoax” claims.

In the United States, the withdrawal from the Paris Agreement—formalized on January 20, 2025, and effective as of January 27, 2026—was merely the opening act of a systematic dismantling of federal and local climate frameworks.

Our previous edition of Transitions explored federal energy policy and its potential failure to keep pace with surging electricity demand. Washington is also targeting local carbon markets.

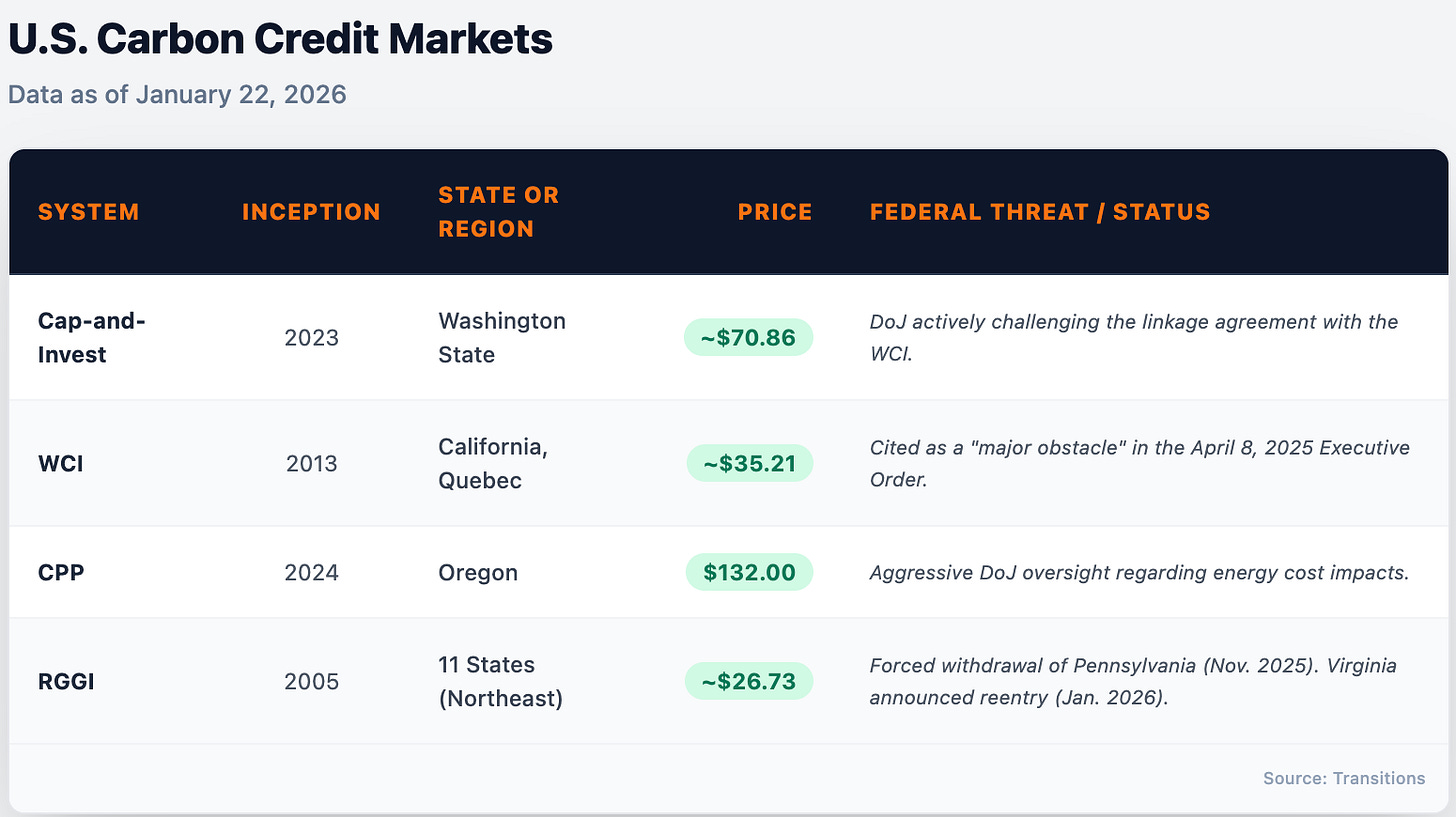

The tone was set by the Presidential Executive Order of April 8, 2025 (“Protecting American Energy From State Overreach”). The text explicitly denounces California’s “radical requirements” and directs the Attorney General to identify all local policies imposing “carbon penalties or taxes.” Under the leadership of the Department of Justice (DoJ), a “flood the zone” approach is underway to paralyze state-level climate initiatives.

Emission Data: A Strategy of Blindness

A major turning point occurred on September 12, 2025, when the Environmental Protection Agency (EPA) proposed terminating the Greenhouse Gas Reporting Program (GHGRP). This program, which centralizes and standardizes emission data from over 8,000 industrial facilities, serves as the indispensable data backbone for carbon market operations.

Faced with the risk of technical collapse—legal proceedings are currently under review—contingency plans are being deployed. The State of New York responded as early as December 1, 2025, by establishing its own reporting system. Both Washington State and New York are currently developing digital infrastructures to replace the EPA’s tools.

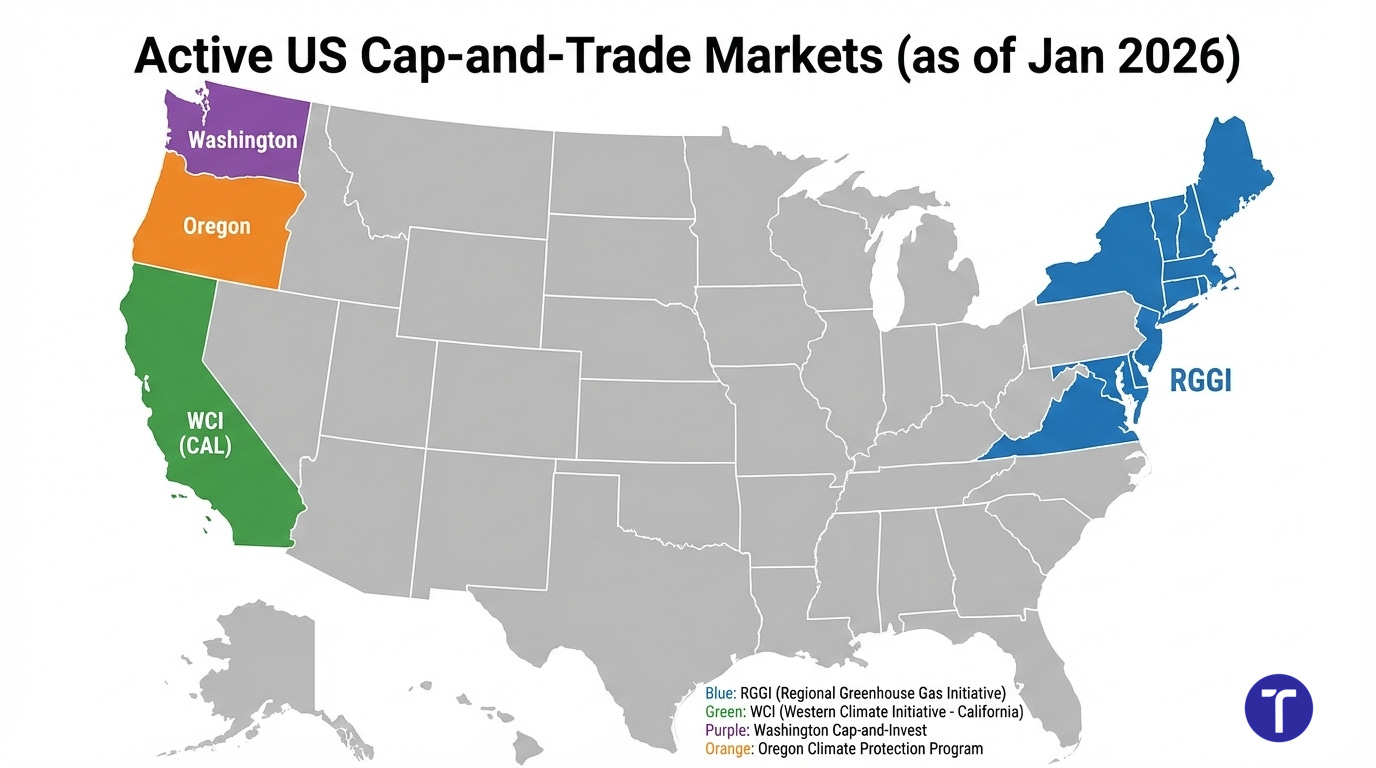

RGGI Buffeted by Local Political Volatility

Carbon markets are increasingly caught in the political crossfire. In Pennsylvania, Democratic Governor Josh Shapiro was forced to resolve his state’s exit from the Regional Greenhouse Gas Initiative (RGGI) in November 2025 to unblock the 2025-2026 budget, following 135 days of Republican obstruction. “It’s time to look forward – and I’m going to be aggressive about pushing for policies that create more jobs in the energy sector, bring more clean energy onto the grid, and reduce the cost of energy for Pennsylvanians,” he stated.

Conversely, in Virginia, newly inaugurated Governor Abigail Spanbergermade rejoining RGGI her first official act upon taking office. “RGGI generated hundreds of millions of dollars for Virginia — dollars that went directly to flood mitigation, energy efficiency programs, and lowering bills for families who need help most. Withdrawing from RGGI did not lower energy costs. In fact, the opposite happened — it just took money out of Virginia’s pocket. It is time to fix that mistake,” she declared on January 19, 2026. The state had previously withdrawn from the market at the end of 2023.

Toward a “Made in GOP” Carbon Tax?

The current administration’s policy is not without its contradictions. On one hand, the Department of the Interior (DoI) is multiplying hurdles for wind projects invoking wildlife conservation concerns to impede progress.

On the other, a faction of Senate Republicans is not ruling out crossing the carbon tax Rubicon—for protectionist reasons. Two bills—the bipartisan Foreign Pollution Fee Act (FPFA) and the Democratic-led Clean Competition Act (CCA), first introduced in 2023—could be placed on the legislative agenda if the Supreme Court limits presidential authority over discretionary tariffs.

“Despite purporting to address this problem, the Trump Administration’s illegal IEEPA tariffs have created economic chaos and worsened many of the underlying dynamics. Congress should set fairer, more predictable trade rules that support a race to the top for global decarbonization,” the CCA’s policy brief states.

Paradoxically, while the Trump administration’s rhetoric dismisses climate change as a “hoax”, it remains a strategic lever. The current dismantling of local carbon markets does not preclude an opportunistic federal pricing scheme, provided it serves to legitimize tariffs and anchor projected budget revenues.