AI vs. Ideology: When Energy Policy Meets Demand Reality

As Washington rolls back the Inflation Reduction Act, its energy doctrine is colliding with a more powerful constraint: surging electricity demand driven by AI and industrial electrification.

While the slogan ‘Make Coal Great Again‘ defined Donald Trump’s first term, his second administration, though not abandoning coal, is pivoting toward gas and nuclear power at the expense of renewable energy, which it deems inefficient.

From Green to Great: The MAGA Policy Reset

From 2022 onward, the uncapped tax credits of the Inflation Reduction Act (IRA) catalyzed a surge in renewable energy development, sidelining fossil fuels.

The One Big Beautiful Bill Act (OBBBA), enacted on July 4, 2025, has largely dismantled this framework. While geothermal remains comparatively insulated, solar and wind face sharply constrained eligibility windows. Projects that fail to reach a material construction milestone by July 2026, or that are not operational by year-end 2027, are excluded from subsidy support — a material shock to late-stage development pipelines.

Beyond ideology, the Trump administration has justified this reversal on fiscal grounds. Initial CBO estimates put the ten-year cost of the IRA at USD 391 billion; revised projections now range from USD 800 billion (Brookings) to nearly USD 1 trillion by 2032 under the Penn Wharton Budget Model, raising concerns over long-term budgetary sustainability.

Capital markets reacted early. Even prior to the OBBBA’s enactment, wind and solar investment fell 18% year-on-year in the first half of 2025, to roughly USD 35 billion, according to a Deloitte report published in October 2025.

The Land-Use Lever: How Density Rules Block Green Energy

Fiscal tightening has been compounded by land-use constraints. Since August 1, 2025, the Department of the Interior has required renewable projects proposed on federal land or waters to demonstrate capacity density comparable to dispatchable assets such as gas or nuclear. Given their physical footprint, solar and wind are effectively disqualified — introducing a de facto siting barrier rather than an explicit ban.

The administration has also escalated its stance offshore. Five wind projects were cancelled in December 2025 on “national security” grounds, opening a new legal front. While recent court rulings — including January 2026 victories for Ørsted and Equinor — have favoured developers, White House spokeswoman Taylor Rogers affirmed that the administration will “keep fighting offshore wind projects” and looks “forward to ultimate victory on the issue.”

The SPEED Act, passed by the House in late 2025, further entrenches this asymmetry. Framed as a permitting reform — with average approval times exceeding 50 months, according to Lawrence Berkeley National Laboratory — a late amendment explicitly favours pipelines and small modular reactors (SMRs). Jason Grumet, CEO of the American Clean Power Association, has criticised the bill for violating the principle of technology neutrality and withdrawn industry support. Senate consideration is expected in Q1 2026.

Rising demand, constrained supply

This policy direction collides with a structural shift in demand. After nearly two decades of stagnation, U.S. electricity consumption began rising sharply in 2023. The acceleration is being driven by AI and data-intensive infrastructure: datacenters accounted for 4.4% of U.S. electricity demand in 2023 and could reach 12% by 2028, according to Berkeley Lab.

S&P Global estimates a generation capacity shortfall of approximately 15 GW by 2028. Near-term responses remain tactical rather than structural: delayed coal retirements, selective nuclear restarts, and incremental optimisation of existing assets.

Meanwhile, more than 2,600 GW of projects remain stuck in interconnection and permitting queues — 85% of which are solar, wind, and battery storage.

From a system-cost perspective, renewables retain a decisive advantage. Solar and storage can be deployed within 12 to 24 months, compared with 4 to 6 years for gas-fired plants and at least 8 to 12 years for next-generation nuclear, including SMRs.

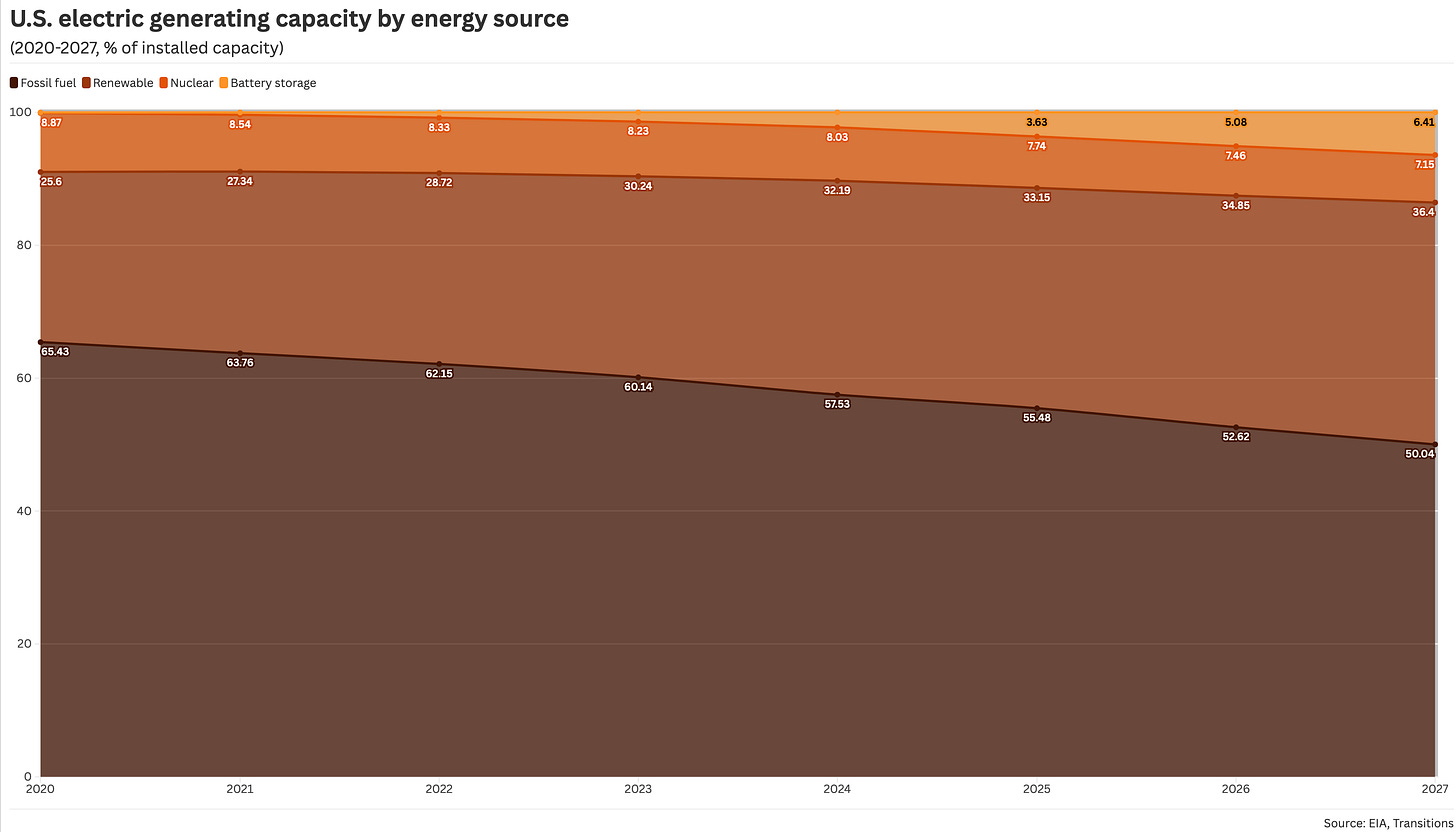

In its January 13 outlook, the EIA projects that capacity growth through 2027 will be driven overwhelmingly by solar, wind, and batteries. Gas and nuclear capacity remain broadly flat, while coal continues its structural decline (see chart).

The Supply Shock: A Dogma Under Pressure

What is emerging is less a clean-energy retreat than a confrontation between ideology and system physics. As U.S. household electricity bills have risen markedly over the past two years, energy affordability is becoming a political constraint — particularly ahead of the midterms. In several states, voter backlash over energy costs may already be contributing to recent Republican setbacks at the local level.

The White House’s National Energy Dominance Council now seeks to compel PJM Interconnection — the grid operator for thirteen Eastern states — to establish dedicated power auctions, forcing Big Tech firms to contribute to the funding of new generation capacity. This initiative, announced on January 16, underscores the fundamental tension at the heart of U.S. strategy: while renewables are being politically sidelined, the administration implicitly acknowledges that the AI boom is creating a structural imbalance, the cost of which it refuses to pass on to voters.